Blog

Investment Market Review & Outlook – October 2018

The ongoing saga of changing US trade policy was the major factor behind much of the stock market activity this quarter, but US and Asian markets reacted very differently to each other.

In addition to intra-country trade negotiations, the US initiated a further interest rate rise in September and another is anticipated in December. The effects of steadily rising rates should not harm equity markets as it looks as though companies are well placed to deal with less generous financial conditions but those with high levels of debt may find things increasingly difficult.

Economic fundamentals remain strong in the US, Europe and Emerging Markets and we believe that these are the bedrock upon which success will be built. We will get a further indication of the health of the market as the next earnings season (the quarterly reporting period for corporations) starts again this month. We anticipate that most companies will demonstrate further positive progress though maybe not at quite the rate of earlier in the year as the effects of tax cuts start to dissipate.

Back home, UK assets struggled to make progress as Brexit negotiations failed to result in any significant headway, but with the deadline looming early next year, a near-term resolution is essential.

Back home, UK assets struggled to make progress as Brexit negotiations failed to result in any significant headway, but with the deadline looming early next year, a near-term resolution is essential.

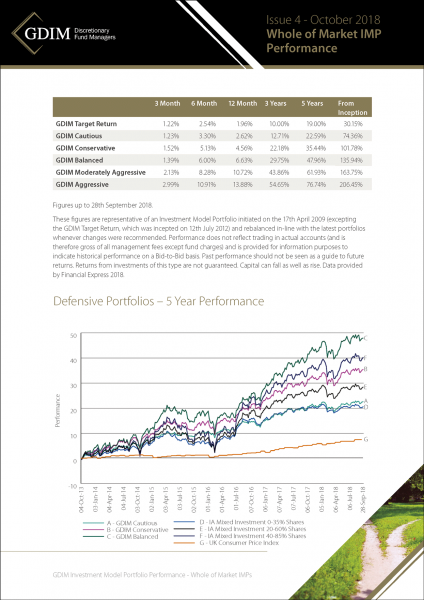

Our portfolios are structured to try and mitigate the damaging effects of market volatility and we retain some highly defensive positions in many portfolios even as we see a fruitful period ahead.

Read our latest Investment Market Review & Outlook for further details:

GDIM Investment Market Review & Outlook – October 2018

GDIM Investment Model Portfolio Performance Sheets – October 2018

View the Video Summary of the Market Review & Outlook:

Newsletter

Sign up to have our latest content delivered straight to your email inbox.

.

.